Why Billions Leak from the Facility Management Sector — and What Contract Managers Can Do About It

The facility management sector in the Netherlands generates an annual turnover of €33.2 billion, accounting for around 4.5% of the country’s GDP. Of this massive amount, about two-thirds is now outsourced to strategic partners. This aligns with an international trend where large companies increasingly choose to outsource not only non-core activities but also essential support services to contracted service providers. The result: organizations no longer compete solely based on their own business model, but also on how effectively they manage their contracted service providers.

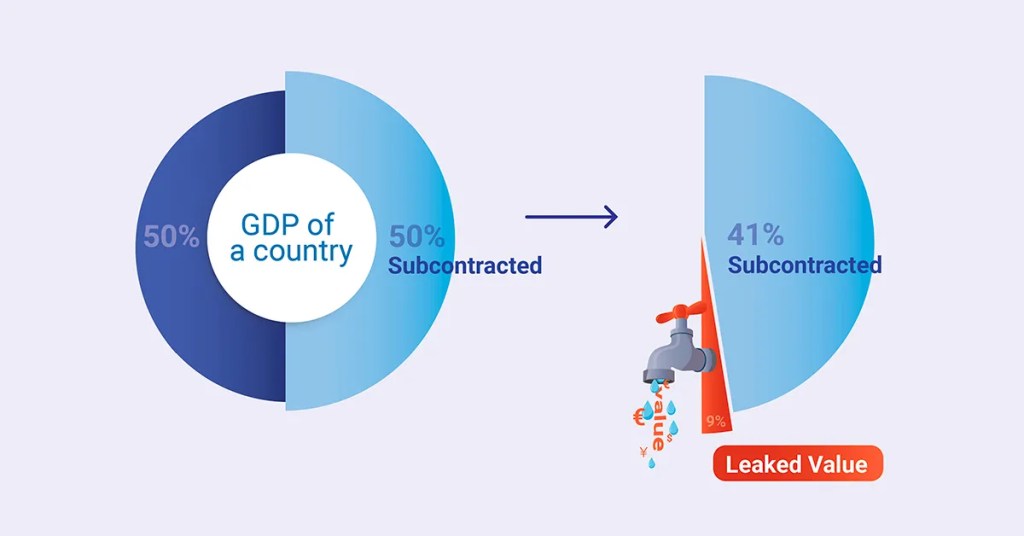

Such outsourcing brings risks, and the numbers don’t lie: the International Association for Contract and Commercial Management (now known as World Commerce & Contracting) calculated back in 2011 that organizations outsourcing services lose on average a staggering 9% of their revenue due to so-called “contract value leak.” Though this study is over a decade old, there’s no reason to believe the situation has improved. In fact, dependence on service providers has only increased—from 60% in 2011 to 66% in 2022.

Contract value leak is not an unavoidable cost of doing business; it is a significant risk. Poorly controlled contracts affect compliance, performance, and relationships. In today’s tight labor market, no client can afford to serve employees bad coffee and sweaty cheese rolls in the company cafeteria or deal with uncleaned toilets. Often, clients will choose not to renew contracts—or even impose penalties. For facility management companies, mitigating contract value leak should be a top priority.

How Value Leaks: Issues with Contract Management

Not all value leak can be prevented by contract managers. Sometimes, the waste is already built into the tender process—for example, by choosing a suboptimal contract type. But the most significant root cause of value leak lies in contract management itself. The most common leaks include:

Overpromising by suppliers during the tender process, with no accountability when promises aren’t kept, as the commitments are buried in proposals or lost in old emails.

Contract changes and change orders are not easily traceable. Clients assume suppliers will comply, even though no one remembers the specifics.

Improvement plans are agreed upon, but no time or personnel are allocated to implement them. Often, the same “improvements” reappear in account plans year after year without actual progress.

Contract end dates are overlooked, leaving clients stuck with underperforming providers because there’s no time to launch a new procurement process.

Inefficient email communication, causing clients to spend excessive time chasing updates, checking commitments, and managing suppliers.

Micromanagement by clients focused on day-to-day operations and complaints, leaving little room to steer strategic added value from the supplier.

All of these issues fall into two main categories:

Monitoring and Compliance Contract managers must ensure all requirements and performance agreements are met and report on them in a traceable, audit-proof manner. This sounds simple, but in practice it takes a disproportionate amount of time and effort.

Most contract managers still rely on the same methods used 10 to 20 years ago: massive Excel spreadsheets, endless email chains, and lots of phone calls to chase people. Mistakes are inevitable with this approach. Outdated financial and performance data may be tolerable, but disagreements over the interpretation of contract terms or changes can result in serious legal costs and frustration. A failure to launch a timely tender can trap an organization with an underperforming supplier for years.

Contract managers are so bogged down with compliance and reporting that they lack time to improve and plan ahead. This is evident in annual research by the Hospitality Group on performance and client satisfaction in the facility sector. In the most recent report focused on the Dutch market (2020), innovation, development, and proactivity received the lowest scores among all evaluated competencies. In practice, this means contracts become outdated and clients lose value as partnerships stagnate. For facility management companies, it’s also a missed opportunity—continued development increases the chance of contract renewal and provides a competitive edge in future tenders.

Plugging the Leak: Professionalizing Contract Management

In short: both clients and facility management companies stand to gain significantly from professionalizing contract management. This is how we can stop millions from leaking out of the sector. A few proposals:

-

Use a Heads of Terms document: A structured list of all commitments made by the bidder. It captures the core of the offer—no supporting evidence, just the plain promises. This aligns with the award criteria and provides both parties with a clear overview of what was committed to.

-

Ensure a traceable record of contract changes: In multi-year contracts, it’s common for changes to be requested. The COVID crisis showed how essential flexibility is. But to avoid conflict, changes must be properly documented. Otherwise, institutional memory may be lost due to illness, leave, or turnover, causing confusion between partners.

-

Implement a shared model for strategic collaboration: Clients rate the FM sector poorly on innovation and proactivity. Facility management companies should proactively propose a shared model for strategic collaboration during the tender. Agree on goals, KPIs, and key projects—and review them regularly together. This ensures the services contribute to the core business and helps both parties evolve, resulting in longer, more innovative partnerships.

-

Automate recurring tasks: Contract managers spend too much time chasing checklists and performance data. It’s time to equip them with better tools than Excel, PowerPoint, and email. Specialized contract management software can automate routine tasks and maintain schedules, freeing up time for strategic thinking and the proactive approach clients want.